Do You Need Special Insurance for Airbnb or Short-Term Rentals?

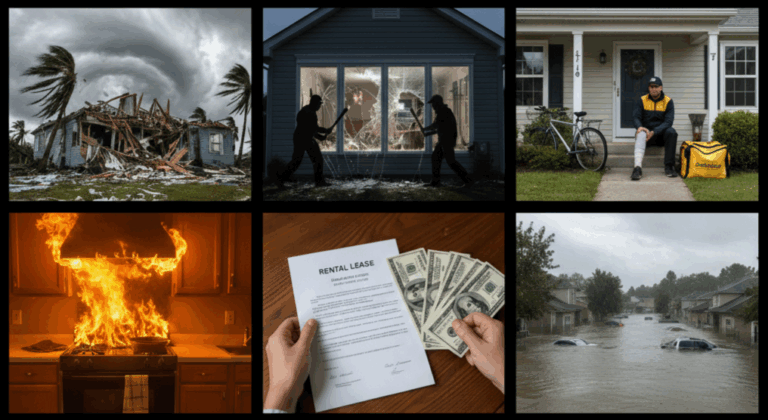

You are surprised that your fall bookings have stacked up and calendars show back-to-back check-ins. That’s awesome! The property is prepped, cleaners are scheduled, and linen orders sit on the porch but guess what’s probably missing: are you sure that you have special insurance for Airbnb or short-term rentals?

Coverlyn hears this story every day — a guest throws a party, and after their checking out the landlord sees some minor loss: shredded upholstery, cigarette burns in a vintage rug, and a crystal lamp. Hosts may assume that short-term rentals platforms build-in home protection will step in. But those coverages are often partial, administratively slow, capped at modest amounts and can exclude intentional acts or high-value items, which leaves landlords puzzling over deductibles and denied line items when the invoice arrives.

For short-term rentals investors and professional landlords the issue is practical and urgent: if damage or liability occurs without proper coverage, it directly affects income. So what’s proper coverage, and do standard homeowner policies, platform provisions, or a tailored STR insurance product actually close the gaps? This Coverlyn’s guide will map common coverage for STRs and show which scenarios typically trigger denials, and outline practical signals that suggest you need a dedicated STR policy.

Why STRs Are Different From Traditional (Long-Term) Rentals

Short-term rentals are somewhere between hospitality and housing, in the grey zone. It’s chaotic and less predictable: each new guest brings unknown habits and care for the space. The constant churn could bring more wear and tear, more keys in circulation, a higher chance of careless damage or theft.

Local regulations could define short-term rentals properties as commercial ventures. That’s why standard homeowner policies often exclude business activity and can void coverage once nightly rates are charged.

In Santa Monica and Miami Beach, for example, hosts must show proof of dedicated short-term rental insurance before receiving a permit, and similar requirements have surfaced not only in the US, but also in European cities from Berlin to Barcelona. These shifting definitions and municipal rules make traditional landlord or homeowner coverage not enough when operating an STR.

Airbnb AirCover and Vrbo Liability Programs

You could probably get acknowledged with different STR platforms insurance products. Coverlyn reminds that besides they could seem pretty handy, they are a safety net with some holes.

Airbnb’s AirCover for Hosts promises big numbers: up to $1 million in liability and as much as $3 million in property-damage protection. It sounds like full insurance, yet it isn’t a regulated policy and functions only when a stay is booked through the platform.

AirCover’s coverage stops at the door for gradual wear, pre-existing damage, natural disasters, cash, jewelry, or shared spaces. Claims must be filed quickly, often within two weeks, and every scratch needs photos, receipts, and estimates. Even then, reimbursement depends on Airbnb’s judgment; hosts that are not first year in business share stories of partial payouts or outright denials despite submitted paperwork.

Vrbo’s offering takes a different shape. Every stay paid through its checkout includes $1 million in primary liability insurance, aimed squarely at injuries or third-party property damage. A guest slips on wet tiles or breaks a neighbor’s fence and the policy can respond, with up to about $5,000 for medical payments. But it does not cover the owner’s own property or contents.

Vrbo sells a separate Accidental Damage Protection plan for guest-caused property damage, but that coverage is optional and carries its own limits. Only reservations processed through Vrbo’s payment system qualify, leaving off-platform bookings exposed.

Airbnb and Vrbo’s hosts protection could deflect certain claims. But they also ignore high-value contents, intentional vandalism, or anything outside a booked stay. Tight reporting windows and strict compliance rules add another layer of risk. Without a dedicated short-term rental policy, serious losses can land squarely on the owner’s ledger.

Why Homeowners Insurance Won’t Cut STRs

Because most standard homeowners policies are written with owner-occupancy in mind. This type of insurance assumes a stable household, not a revolving door of strangers checking in every few days. If you use your property as a short-term rental without disclosure, be prepared that it could jeopardize your homeowners insurance coverage entirely. One rented out weekend may leave you personally liable for possible home damage or guest’s injury. Insurers could classify the property as “business use” and trigger exclusions or outright denial of claims. So maybe relying on standard homeowners insurance for short-term rentals is extremely brave.

Traditional Landlord Insurance vs. STR Insurance

Predictable occupancy, known tenants, and limited turnover. Traditional landlord insurance is all about cases where something happens with or because of long-term tenants who live there for months or years. It could cover physical damage to the building and liability claims from your long-term tenants or their visitors. Some policies could repay even loss of rent, if your property becomes uninhabitable due to a covered event.

STR insurance specifically addresses the high turnover and variable guest behavior that come with multiple and frequent bookings. Policies include coverage for your clumsy guest-caused property damage, from broken furniture to stained carpets. This type of coverage may extend liability protections for incidents arising from frequent guest use. You could also trade a policy that will cover loss of rental income if a covered event forces cancellations.

Short-term rental insurance could carry a 25% higher premium than traditional landlord coverage. Let’s repeat, why: frequent guest turnover, accidental damage, and liability claims.

Multiple factors could influence the cost of an STR insurance plan: the property type, the property location, the frequency of bookings, and even amenities such as a pool, hot tub, or some fancy appliances. So no-brainer, that a luxury condo in downtown Miami with nightly bookings will cost more to insure than a modest single-family home rented occasionally somewhere in a boring suburban area.

Check out also if you could incorporate short-term rental riders or add-ons into existing landlord policies. For professional investors managing multiple listings, this can be a cost-effective way to ensure continuous coverage. With Coverlyn, STR investors, Airbnb and Vbro hosts can easily compare whether a landlord policy plus an STR rider or a dedicated STR policy is the better fit.

Real Risks That STR Insurance Covers

Short-term rental insurance exists because everyday scenarios can quickly become costly without proper liability coverage. Your guest could sue you for damaging any part of their bodies because of some issues with your property. And you know, legal fees and medical claims could wipe out months of rental income.

Party damage is another common headache: an unauthorized celebration leaves hundreds of dollars in glasses shattered, carpets stained, and furniture destroyed. STR insurance could also cover loss because your guest or their friends accidentally stole your silver cutlery or designer poster. Btw, theft of home appliances often falls outside the protection offered by AirCover or Vrbo’s liability program.

Don’t forget that property loss and income interruptions could multiply your losses. Lost bookings during peak season can quickly outweigh repair costs alone. In this case dedicated STR insurance can reimburse both the physical damage and the lost rental income.

Regulatory compliance is greatly underrated but increasingly relevant: some municipalities and certain banks require proof of STR or landlord insurance before issuing permits or lending you money. Beyond money, there’s reputational risk. An uncovered claim could not only drain you financially but also threaten hosting privileges or city licenses.

How to Get Your STR or Airbnb Covered Easily with Coverlyn

If you read our guide to this paragraph, you already feel that navigating short-term rental insurance looks like the Minotaur myth. Airbnb and Vrbo platform-driven protections cover only a fraction of potential losses. Standard homeowners or landlord insurance rarely protects STR activity. For serious hosts, specialized coverage could be legally or contractually required, so it’s not just “a nice-to-have”.

Coverlyn streamlines the short-term rentals insurance policy build-up process. We let landlords and hosts compare policies, STR riders, and full landlord coverage in a smart way. Our clients say that we bring transparency, speed, and a custom fit for their portfolio. Protect your income stream and property, minimize risk, and gain the confidence that comes from knowing your STR investment is most protected.